Stripe is a leading payment processing platform trusted by businesses worldwide.

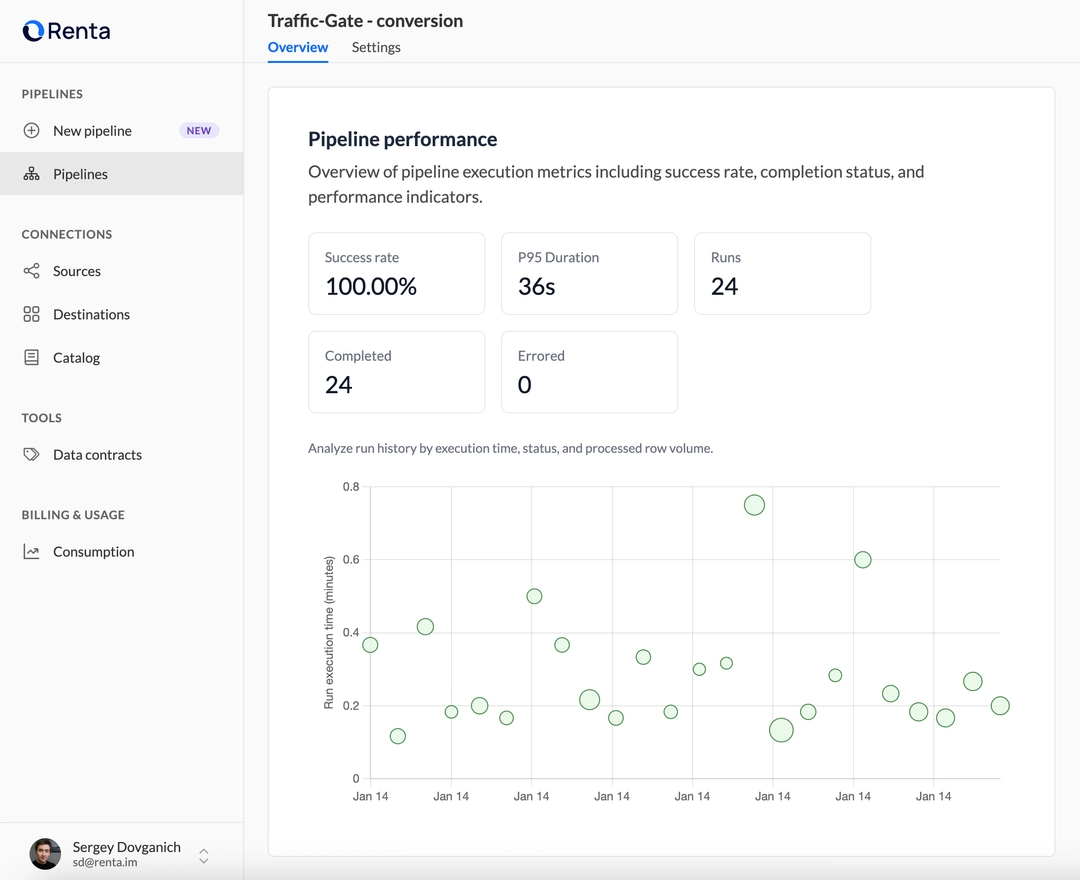

Renta Marketing ELT seamlessly moves your Stripe data into Snowflake, enabling fast, automated, and secure analytics for your team.

Unlock actionable insights and optimize your marketing and finance strategies with reliable, up-to-date data at your fingertips.

ETL Stripe data to Snowflake

Free for 7 days. No credit card required.

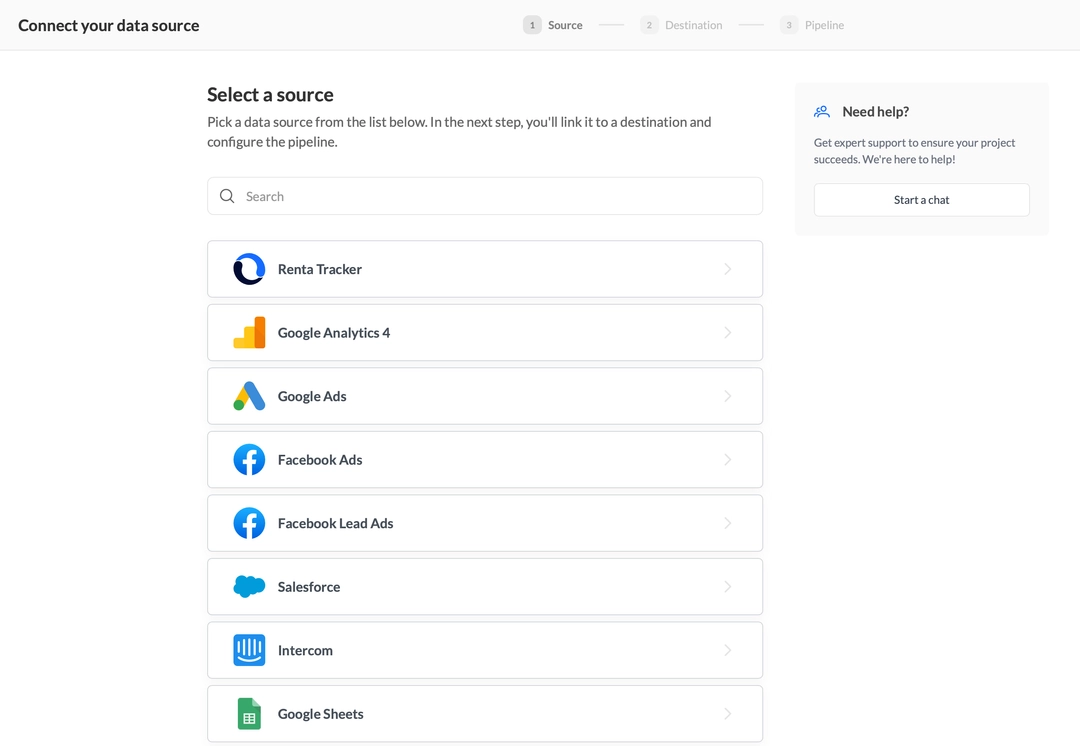

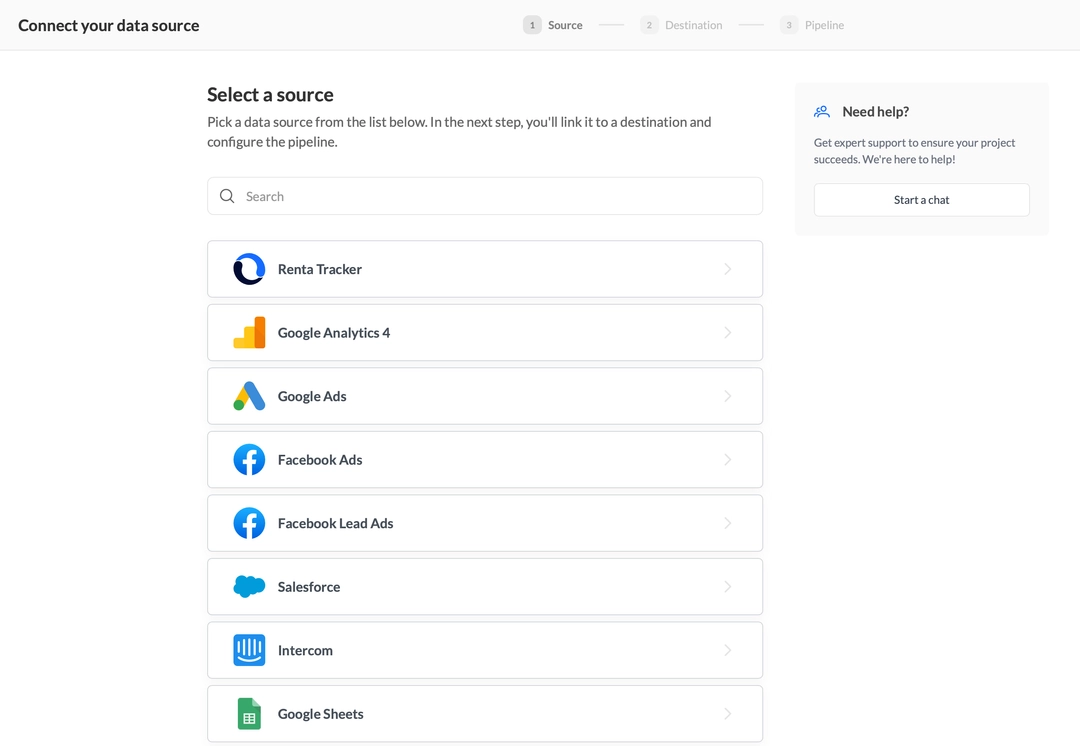

Set up your ELT pipeline in 3 simple steps

Select Stripe as your data source and securely authenticate your account to initiate the data extraction process.

Select Stripe as your data source and securely authenticate your account to initiate the data extraction process.

Renta supports 8 methods of data export using the Stripe API.

Charges

Represents individual payment transactions processed through Stripe, including details such as amount, currency, payment method, customer, and transaction status.

Customers

Stores information about end users or businesses making payments, including contact details, payment methods, and billing history.

Invoices

Manages billing documents issued to customers, containing line items, amounts due, payment status, and links to related charges and subscriptions.

Payments Intents

Handles the lifecycle of a payment from initiation to confirmation, supporting complex payment flows and compliance requirements such as SCA.

Payouts

Tracks transfers of funds from your Stripe account to external bank accounts, including payout amounts, schedules, and statuses.

Refunds

Records details of returned funds to customers, including refund amounts, reasons, and associated charge references.

Subscriptions

Manages recurring billing agreements with customers, detailing plan information, billing cycles, and current subscription status.

Balance Transactions

Provides a ledger of all movements in your Stripe account balance, including charges, refunds, payouts, and fees.

Unlock actionable Stripe insights

- Track customer lifetime value by merging Stripe payments with product usage data in Snowflake

- Detect churn risk by analyzing failed payments and subscription downgrades in real time

- Automate revenue recognition by syncing Stripe transactions with finance dashboards in Snowflake

- Segment high-value customers by combining Stripe revenue and marketing attribution data

- Monitor refund rates and dispute trends across regions for proactive risk management

- Forecast monthly recurring revenue by aggregating Stripe subscription data in Snowflake

Start quickly with these use case templates

Free for 7 days. No credit card required.

Automate extraction from 100+ connections. 99.9% Uptime SLA.